That Refund You Got? It Should've Been Bigger.

Your tax preparer missed things. We find them. While you're handing the IRS money you don't owe, we're the ones who get it back. 40+ years of "how did my last guy miss this?" Zero judgment. Just results.

You're Getting Played. And You Feel It.

Every April, you hand over your documents, cross your fingers, and accept whatever number they give you. Deep down? You know something's off. You're right.

Ever wonder why your coworker—same job, same salary—gets THOUSANDS back while you OWE? That's not luck. That's their preparer actually doing their job.

Remember that 15-minute appointment? No real questions. No strategy. Just "sign here" and "that'll be $300." You felt rushed because you WERE rushed.

That little voice saying "I'm probably missing something"? Listen to it. You ARE missing something. Probably a lot of somethings.

What You've Been Getting vs. What You Deserve

One approach leaves you stressed and shortchanged. The other leaves you confident and cashing a bigger check. Your call.

What You've Been Getting

The "Good Enough" Approach

- Copy-paste from last year. Zero effort.

- In and out in 15 minutes. NEXT!

- Doesn't ask questions. Doesn't dig.

- Surprise fees after you've already committed

- Vanishes after April. Good luck reaching them.

- IRS sends a letter? You're on your own.

- Makes you feel dumb for asking questions

- Jargon you don't understand. Nods you don't mean.

- Misses deductions that cost you THOUSANDS

- You're a number. They don't remember your name.

What You Deserve

The "We Actually Care" Approach

- Deep dive into YOUR specific situation

- We take our time. Your money is worth it.

- Questions others don't think to ask

- Price upfront. No surprises. No games.

- Here year-round. We don't ghost.

- Audit support included. We handle it.

- No shame. No judgment. We've seen it ALL.

- Plain English. You'll actually understand.

- Hunt for EVERY deduction like it's our money

- We know your name. We know your story.

Which experience would you rather have this tax season?

We Treat Your Money Like It's Ours

This isn't a side gig for us. We eat, sleep, and breathe tax strategy. And we won't rest until we've found every dollar hiding in your return.

We Hunt. We Dig. We Find.

- Deductions your last 3 preparers walked right past

- Side gigs = goldmines (if you know where to look)

- We don't stop until there's nothing left to find

We Actually Pick Up

- Call us. We answer. Revolutionary, right?

- Plain English. No jargon. No talking down.

- Your questions matter. Ask them.

No Surprises. No Games.

- Your quote is your quote. That's it.

- We explain what you're paying for

- Hidden fees? Not here. Not ever.

We Don't Disappear

- IRS sends a letter? We're on it.

- Audit support included. No extra charge.

- July question? October problem? Call us.

This Is What It Feels Like to Have Someone In Your Corner

Not a robot. Not a seasonal temp. A real person who knows your name, knows your situation, and fights for your money like it's theirs.

Tired of crossing your fingers and hoping your return is right?

What would it mean to KNOW—really know—that someone's got your back?

Here's How We Get You What You're Owed

No confusing software. No awkward office visits. Just upload, relax, and watch us work.

Quick intake form. Your situation, your income, your concerns. No judgment—just honest questions that actually matter.

This is where we start finding money. New baby? Side hustle? Medical bills? Things happen. Each one triggers deductions your last preparer probably ignored.

We don't skim. We don't rush. We dig through everything looking for money you're owed.

Mileage? Home office? Equipment? Subscriptions? We find deductions you forgot existed. This is where generic preparers phone it in—and where we shine.

We walk you through everything. Plain English. No jargon. You'll know exactly what you're filing and why.

And when you get that refund? We're still here. Question in August? Call us. IRS letter in November? We've got you. We don't ghost.

Imagine actually KNOWING your taxes are right. Not hoping. Knowing.

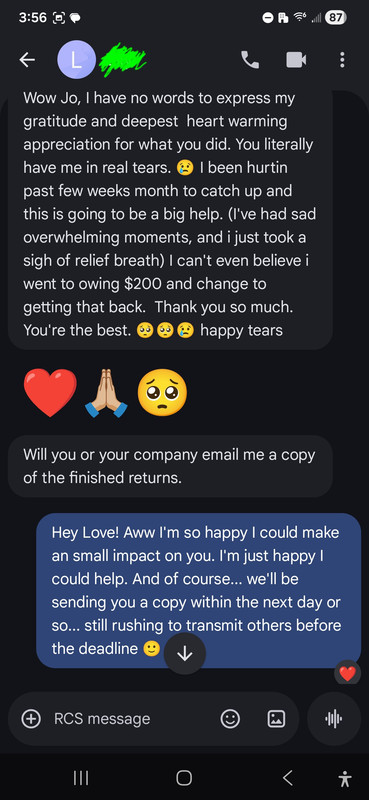

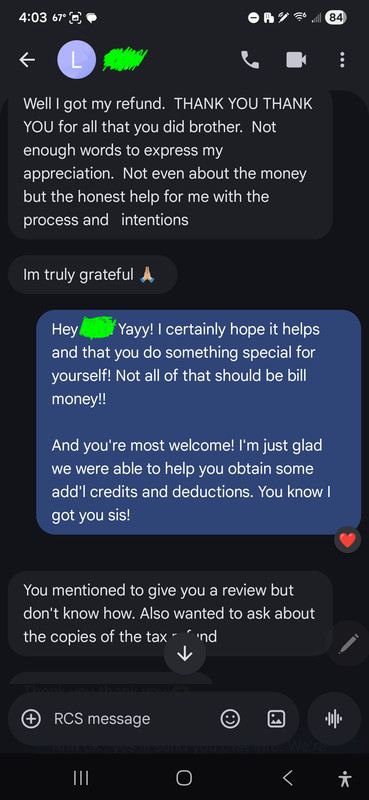

Then They Found Us. Here's What Happened.

"6 years of TurboTax. $800-$1,200 back every time. Thought that was just... what I got. First year with Legitimate Tax? $4,300. FORTY-THREE HUNDRED. Same job. Same income. Just someone who actually looked."

"I was TERRIFIED. Thought I'd messed up bad. They didn't judge me—not even a little. Just said 'let's fix it.' Found money I didn't know existed. First time I've slept through April in years."

"My old accountant? $400 for 20 minutes of his time. These guys spent HOURS with me. Found $3,000 my 'professional' missed. I was literally paying someone to leave my money on the table."

"Every. Single. Year. I owed. Same job, same income. This year? $1,800 BACK. Same everything—except now I have someone who actually knows what they're doing. I'm still mad it took me this long."

"12 years self-employed. 12 years of preparers who didn't get it. These people UNDERSTOOD my business. Found $2,300 more than my last guy. I'm done looking. Found my people."

These people were exactly where you are right now. Frustrated. Suspicious. Hoping for better. They took the leap. Now they're sleeping at night. Your turn?

How Much Longer Are You Going to Let It Slip Away?

Every year you wait is another year of overpaying. Another year of "that's just how taxes work." It doesn't have to be this way. Let us prove it.

Show Me What I'm Owed →This Is What Tax Prep Should've Been All Along

Bigger refunds. Actual support. Someone who remembers your name. Wild concept, right?

Life Happens. We Catch It.

New baby? New house? Side gig? Divorce? Each one triggers deductions. Your last preparer probably didn't even ask. We don't miss these. Ever.

Fast—But Not Sloppy

3-5 days for most returns. But we're not racing through to grab the next client. We're being thorough. Your money deserves more than 15 minutes.

We Remember You

Next year? We already know your story. No starting from scratch. No re-explaining everything. Just "what's new?" and finding more ways to save.

Self-Employed? You're Home.

Rideshare. Freelance. Gig work. Side hustles. This is where lazy preparers fail hardest—and where we find the MOST money. Try us.

Your Info Is Locked Down

Bank-level encryption. Secure portal. We're paranoid about your data so you don't have to be. Nothing leaves our hands. Nothing.

Past Years? We Can Fix Those.

Been overpaying for years? We can amend up to 3 years back and RECOVER that money. Some clients get back thousands they already gave away.

How much did you overpay last year? The year before? The year before that? Want to find out?

What would it feel like to finally have someone in your corner who treats your money like it matters?

Everything You Need to Know Before We Start

No surprises. No fine print. Just straight answers.

Software asks generic questions and accepts your answers. H&R Block rushes you through with seasonal workers who disappear in May. We INVESTIGATE. We probe. We ask follow-up questions software never thinks of. We find deductions that don't fit in neat little boxes. That's the difference between an algorithm and an expert advocate who actually gives a damn about your refund.

Absolutely—and with ZERO judgment. We've seen it all. Many clients come to us terrified about past errors. Here's the truth: the fear is usually worse than the reality. We'll review your situation, figure out what (if anything) needs fixing, and guide you through it. We can even file amendments going back 3 years to recover money you already overpaid.

Depends on complexity, but here's what matters: we quote you upfront and that's what you pay. No surprise fees after you submit docs. No bait-and-switch. And here's the thing—clients almost always get back WAY more than our fee in found deductions. Fill out the intake form and we'll give you exact pricing within 24 hours.

We provide full audit support at NO additional cost for any return we prepare. If the IRS has questions, we handle it. We don't disappear like your last preparer would. Because we file correctly from the start, audits are extremely rare—but if it happens, we've got your back 100%.

This is literally our specialty. Rideshare, freelance, gig work, small business—these situations are GOLDMINES for deductions that lazy preparers miss. Home office? Mileage? Equipment? Phone bill? Internet? We know exactly what you can claim and how to document it properly. The more complex your situation, the more money we find.

Most returns completed in 3-5 business days once we have everything. But unlike your current preparer, we're not rushing to get to the next client—we're being thorough to find every dollar. We'll keep you updated the whole time. No ghosting. No wondering where things stand.

Nope. We're 100% virtual. Upload docs securely, talk via phone, email, or video—whatever works for you. Handle your taxes from your couch, your car, or wherever. It's 2025. You shouldn't have to take time off work to sit in some strip mall waiting room.

100% satisfaction guaranteed. If you're not completely happy, we make it right. Period. We're not satisfied until you are—because your peace of mind is the whole point. Who else in this industry offers that? Exactly.

📋 Your Intake Form Goes Here

Embed your form (Typeform, JotForm, Google Forms, etc.)

Let's Find Out What You're Really Owed

Fill this out. We'll look at your situation and tell you—honestly—if we can help. No sales pitch. No pressure. Just the truth about what you've been missing.

You're In The Right Place If:

- That gut feeling says you're leaving money on the table

- You've got a side gig, hustle, or small business nobody seems to "get"

- You're DONE with 15-minute rush jobs and zero explanation

- You're scared about past years but need someone who won't judge

- You want to actually TALK to a human who answers the phone

- You're ready to stop hoping and start KNOWING

What if next year's refund could be 2x, 3x, or even 4x what you got this year?

What's it worth to finally have someone who gives a damn about your money?